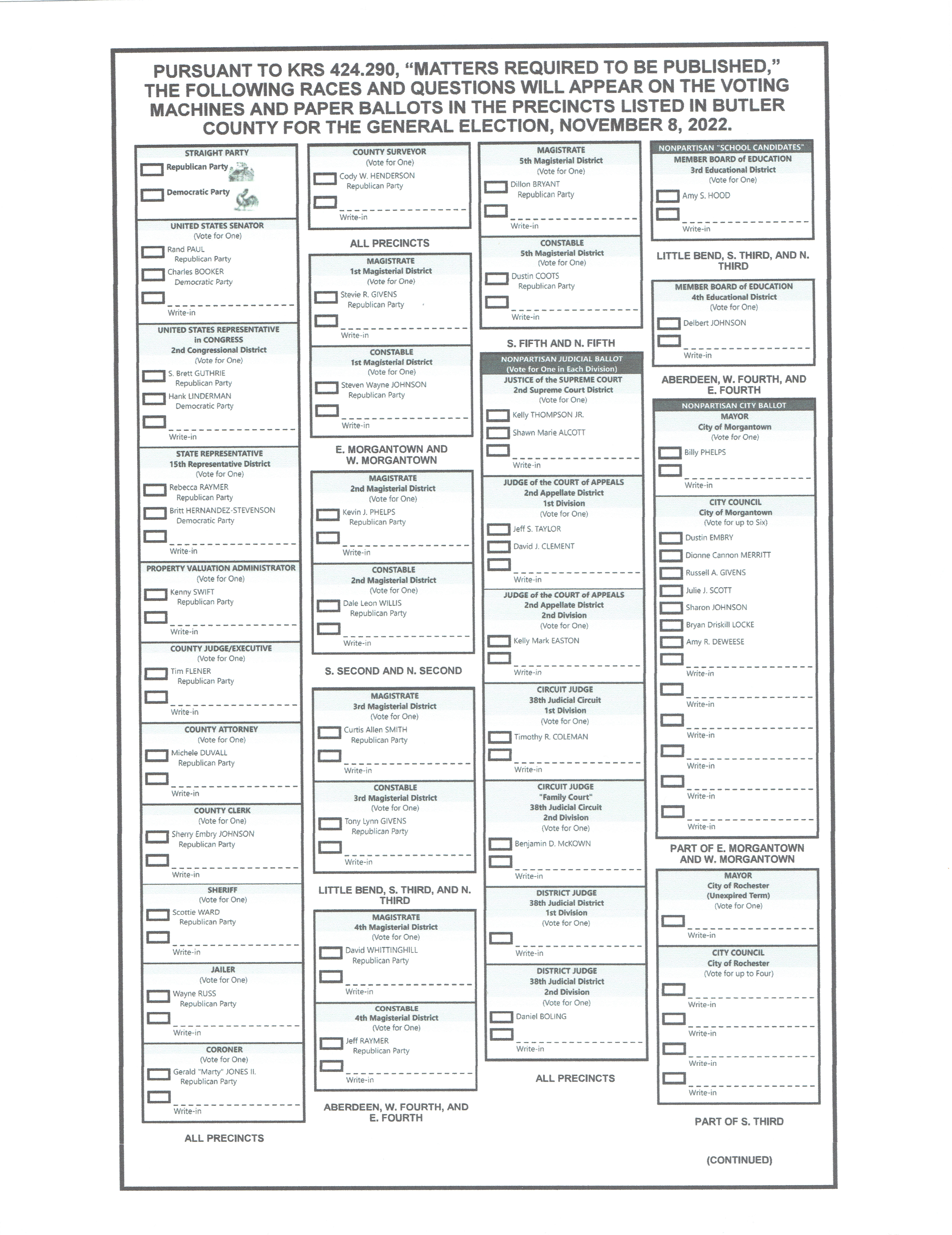

butler county kansas vehicle sales tax rate

Affidavit of Correction TR-292. 2020 rates included for use while preparing your income tax deduction.

Form Dst 8 Fillable Sales Tax Receipt

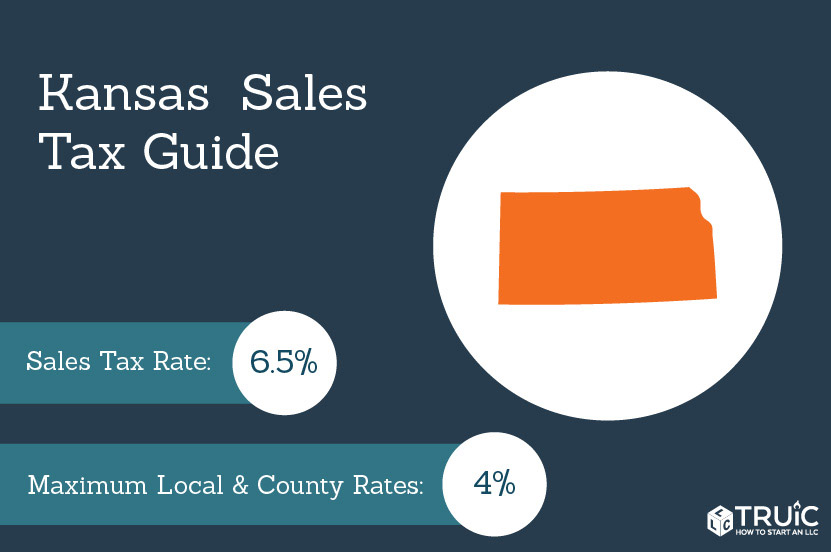

Kansas has a 65 statewide sales tax rate but also.

. Lowest sales tax 55 Highest sales tax 115 Kansas Sales Tax. The Kansas state sales tax rate is currently. You may use Visa Mastercard or Discover creditdebit card to pay online at the kiosk or in person at either the Olathe or Mission office.

Some cities and local governments in Butler County collect additional local sales taxes which can be as high as 4. If you do not receive a tax statement by December 1 please contact our office at 316 322-4210. The sales tax rate for hutchinson was updated for the 2020 tax year this is the current sales tax rate we are using in the hutchinson kansas sales tax comparison calculator.

The average cumulative sales tax rate between all of them is 663. This is the total of state and county sales tax rates. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

679 rows 2022 List of Kansas Local Sales Tax Rates. This rate includes any state county city and local sales taxes. The Butler County Tax Claim Bureau participates in three kinds of sales on a yearly basis.

As far as all cities towns and locations go the place. For vehicles that are being rented or leased see see taxation of leases and rentals. If you do not receive a tax.

Butler County in Kansas has a tax rate of 675 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Butler County. Abandoned Vehicle Affidavit TR-105. Missouri has a 4225 sales tax and Butler County collects an additional.

The Butler County Ohio sales tax is 650 consisting of 575 Ohio state sales tax and 075 Butler County local sales taxesThe local sales tax consists of a 075 county sales tax. Cassoday KS Sales Tax Rate. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Learn how to renew motor vehicle tags. The Kansas sales tax of 65 applies countywide. Tax statements are mailed late November.

Tax statements are mailed late November. The total sales tax rate in any given location can be broken down into state county city and special district rates. Average Sales Tax With Local.

The mill levies are finalized in October and tax information is available in mid to late November. The most populous location in Butler County Kansas is El Dorado. Renew your vehicle tags online through the Kansas Motor Vehicle Online Renewal System.

This may be done at either Butler County Motor Vehicle Office with the proper documentation and the payment of fees property tax and sales tax where applicable. Affidavit of Purchase Price TR-312. Affidavit for Charitable Organization Vehicle Auction TR-110.

Find information on the mill levy or the tax rate that is applied to the assessed value of a property. The minimum combined 2022 sales tax rate for Butler County Kansas is. Butler County Sales Tax Rates for 2022.

To view current creditdebit card and e-check. The latest sales tax rate for Butler County KS. Tax Rate Schedules for Butler County by Taxing District.

You will need your renewal forms sent to you from the Kansas Department of.

Sales Tax On Cars And Vehicles In Ohio

Butler County Kansas Watercraft Bill Of Sale Download Printable Pdf Templateroller

Revenue Vs Savings If Kansas Missouri Cut Food Tax

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Sales Tax On Food Is Second Highest In Nation

Oil Fields Fire Rppc Augusta Kansas Rare Antique Butler County Photo Pc 1916 Ebay

Finance Department Andover Ks Official Website

My Local Taxes Sedgwick County Kansas

Cdc Report Covid 19 Cases Dropped In Kansas Counties With Mask Orders Rose In Others The Kansas City Star Kansas Association Of Counties

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Kansas Sales Tax Small Business Guide Truic

Protesting Taxes Butler County Ks Official Website

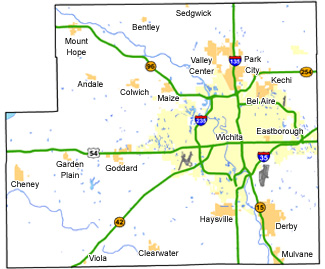

County Wide Maps Sedgwick County Kansas

Kansas Property Tax Calculator Smartasset

Butler County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More